Review the step-by-step instructions on how to obtain tax transcripts and submit proof of Selective Service registration, citizenship status, and eligible noncitizen status.

How to Upload Documents

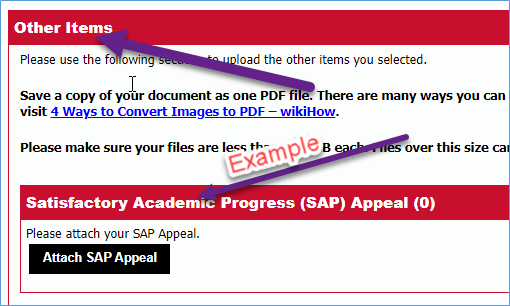

Step 1. Save a copy of your document as one PDF file. There are many ways you can save a file or an image as a PDF file. If you need help on how to save a file to PDF, visit 3 Ways to Save a PDF file- wikiHow. If you need help saving an image as PDF, you can visit 4 Ways to Convert Images to PDF – wikiHow.

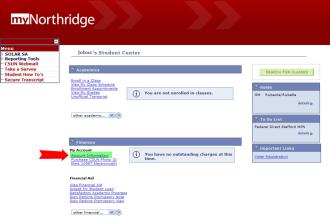

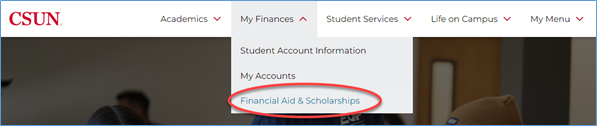

Step 2. Log onto the CSUN Portal, once you are logged in, navigate to My Finances and select Financial Aid & Scholarships.

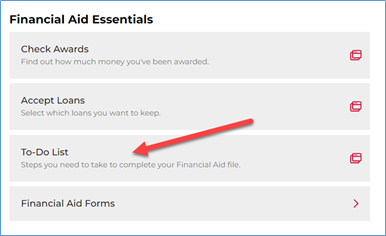

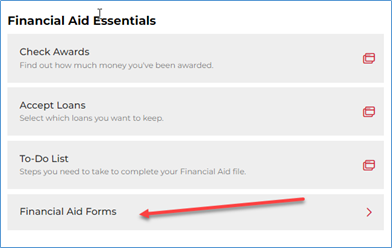

Step 3. Scroll down to the Financial Aid Essentials section and select Financial Aid Forms

Step 4. Within Financial Aid Forms, select Financial Aid Document Upload. This link will take you to the page where you can submit your documents.

Step 5. Select the Award Year and the type of document you would like to submit. Note: Confirm if the document you are submitting is listed on your To Do List and if so, select that option. All other documents should be submitted by selecting “Other Items”.

Step 6. If you selected the option “Items from my To Do List”, scroll down to see a new section that will provide you with the option to attach the document based on the items on your To Do List. See example below:

Step 7. If you selected the option “Other Items”, scroll down and you will have a list of documents that can be submitted. Select the items and scroll down to attach the documents using the options provided for each item.

Step 8. After attaching all the documents, make sure you select the Submit button.

Step 9. After successfully submitting your documents, you will receive a confirmation page.

How to Submit the Electronic Dependent Verification Worksheet

1. Go to the CSUN home page and log into the CSUN Portal

2. Once you are logged in, navigate to My Finances and select Financial Aid & Scholarships.

3. Scroll down to the Financial Aid Essentials section and select To-Do-List

4. Select the Dependent Verification 24/25 (if enrolling in Fall 2024, Spring 2025, or Summer 2025) OR Select Dependent Verification 24/25 (if enrolling in Fall 2023, Spring 2024, or Summer 2024)

5. Click to Submit 2024-2025 OR 2023-2024 Dependent Student Electronic Verification (e-verification) Worksheet

The Dependent Verification electronic form (E-form) will open in a new window.

Please complete all sections of the E-form, print, and then click the Submit button to transmit the form electronically.

You will need to submit the Signature Page and any IRS Tax Return Transcript or copies of singed Tax Returns (if requested) to the Financial Aid & Scholarship Department.

Step One: Student Information

Note: Your Last Name, First Name, CSUN ID and Award Year will already be populated.

2024-2025 Verification Worksheet Dependent Student

For Award Year, make sure 2024-2025 is selected.

For Application Type, indicate whether you filed the Free Application for Federal Student Aid (FAFSA) or California DREAM application.

Step Two: Household Information – Family size is based on the number of individuals listed and claimed on your IRS Tax Return. List the following people in your household: List yourself, your parent or parents reported on the financial aid application and your parent’s dependents. Provide the person’s full name, relationship to you, and age.

- Click the Add New Family Member button to add each person to the chart, start with yourself.

- Do not include Foster Children.

If you make an error, use the Delete button within the chart to remove a family member.

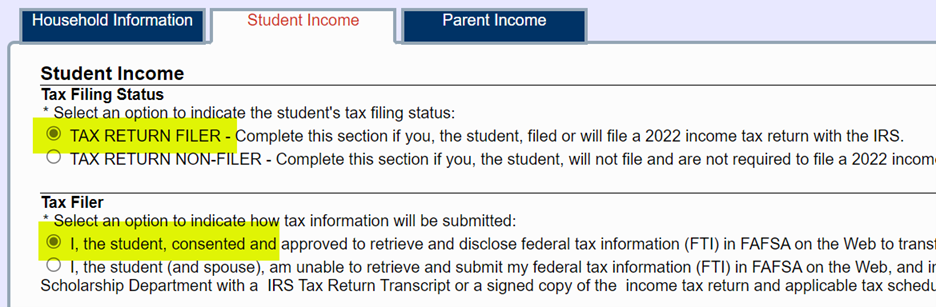

Step Three: Student Income

Once you are done with the Household Information section, select the Student Income tab or press the NEXT – Student Income button to go to next section.

Tax Filing Status – Indicate whether you filed or will file a federal income tax return; otherwise, indicate that you are not required to file a federal income tax return with the IRS.

a. If you Filed or Will File Taxes:

- Select the Tax Return Filer button

- Select “I, the student (and spouse), consented and approved to retrieve and disclose federal tax information (FTI) in FAFSA on the Web to transfer 2022 IRS tax return data into my FAFSA.

- You do NOT need to submit any tax documentation

- Note: The consent to transfer income information is not available to California Dream applicants.

b. If you Filed Taxes and Will Submit IRS Tax Return Transcript

- Select the Tax Return Filer button

- Select “I, the student, am unable to retrieve and submit my federal tax information (FTI) in FAFSA on the Web, and instead will provide the Financial Aid & Scholarship Department with an 2022 IRS Tax Return Transcript or a signed copy of the income tax return and applicable tax schedules.

- Dream students select “I, the student will provide the Financial Aid & Scholarship Department my 2022 IRS Tax Return Transcript(s) or a signed copy of the 2022 income tax return with any applicable tax schedules.”

c. If you Did Not Work Or Earn Income

- Select the Tax Return Non-Filer button

- Select “I, the student, was not employed and had no income earned from work in 2022.”

d. If you Earned Income Below the IRS Requirement to File

- Select the Tax Return Non-Filer button

- Select “I, the student, was employed in 2022 and earned money, but was NOT REQUIRED to file a 2022 income tax return with the IRS.”

- Select “I, the student, will provide the Financial Aid & Scholarship Department with a copy of all my 2022 IRS W-2 forms issued by my employers.”

Step Four: Parent Income

Select the Parent Income tab or press the NEXT – Parent Income button to go to the next section.

Please refer to the section Step Three: Student Income of this document for instructions on how to complete the Parent Income section. The general instructions are the same, except, if your parents were not required to file. If your parents were not required to file taxes, they will have to submit a “Verification of Non-Filing Form.”

a. If your parents Earned Income Below the IRS Requirement to File,

- Select the Tax Return Non-Filer button

- Select “I/We, the parent(s), were employed in 2022 and earned money, but were NOT REQUIRED to file a 2022 income tax return with the IRS.”

- Select ““I/We, the parent(s), will provide the Financial Aid & Scholarship Department with a copy of all 2022 IRS W-2 forms issued by all employers as well as CSUNs Verification of Non-Filing Form.”

b. If your parents Did Not Work Or Earn Income

- Select the Tax Return Non-Filer button

- Select “I/We, the parents, were not employed and had no income earned from work in 2022.”

Special Instructions for Parents who are Unmarried and Living Together: If both parents filed taxes or earned income, you must submit separate IRS Tax Return Transcripts and applicable schedules for each parent or other income documentation (i.e. W-2 forms).

Step Five: Review, Print and Submit Form Electronically

Review and Print E-form – It is important that you provide accurate responses to all questions, especially required fields which are denoted with an asterisk.

a. Use the Print button to review and print the Electronic Dependent Verification Worksheet.

![]()

- The system will review the electronic form for completeness and/or errors.

- You will not be able to print if your electronic form is missing information or if there are errors to resolve.

b. At least one parent reported on the Free Application for Federal Student Aid (FAFSA) or California DREAM application must sign and date the last page (Signature Page).

c. Sign the Last Page of Your Printout – You and at least one parent reported on the Free Application for Federal Student Aid (FAFSA) or California DREAM application must sign and date the last page (Signature Page).

d. After you successfully print the E-form, the Submit button will become available.

e. Click the Submit button once located at the bottom of the form

Submit the E-form ONCE – Click the Submit button one time to transmit your data to the Financial Aid & Scholarship Department.

![]()

f. If you make an error, do not resubmit this form. Please contact the Financial Aid & Scholarship Department at (818) 677-4085 or come into the Bayramian Hall lobby windows for further instructions.

g. You will receive the following message. Click OK to proceed and submit your E-form to the Financial Aid & Scholarship Department.

h. You will receive the following confirmation page.

Step Six: Upload or Mail Documents

Sign the Last Page of Your Printout – You and at least one parent reported on the Free Application for Federal Student Aid (FAFSA) or California DREAM application must sign and date the last page (Signature Page).

Submit the Signature Page and any other documents to the Financial Aid & Scholarship Department using ONE of the following options: CSUN Portal or mail.

CSUN Portal – submit the documents by logging onto the CSUN Portal. Once you are logged in, the Financial Aid Document Upload page is located under – My Finances – Financial Aid & Scholarships – Financial Aid Essentials - Financial Aid Forms. You can view the tutorial on How To Submit Documents to learn how to navigate to the Financial Aid Document Upload page.

Mailing address:

California State University, Northridge

Financial Aid & Scholarship Department 18111 Nordhoff Street

Northridge, CA 91330-8307

For detailed information about documents you may need to return to us, please review the Verification Guide.

How to Submit the Electronic Independent Verification Worksheet

1. Go to the CSUN home page and log into the CSUN Portal

2. Once you are logged in, navigate to My Finances and select Financial Aid & Scholarships.

3. Scroll down to the Financial Aid Essentials section and select To-Do-List

4. Select the Independent Verification 24/25 (if enrolling in Fall 2024, Spring 2025, or Summer 2025) OR Select Independent Verification 23/24 (if enrolling in Fall 2023, Spring 2024, or Summer 2024)

5. Click to Submit 2024-2025 OR 2023-2024 Independent Student Electronic Verification (e-verification) Worksheet

The Independent Verification electronic form (E-form) will open in a new window.

Please complete all sections of the E-form. The last step is to electronically sign and submit the E-form through the Portal.

You are required to turn in income documentation such as an IRS Tax Return Transcript or copies of your singed Tax Returns to the Financial Aid & Scholarship Department only if you manually entered income information

Step One: Student Information

Note: Your Last Name, First Name, CSUN ID and Award Year will already be populated.

2024-2025 Verification Worksheet Independent Student

For Award Year, make sure 2024-2025 is selected.

For Application Type, indicate whether you filed the Free Application for Federal Student Aid (FAFSA) or California DREAM application.

Step Two: Household Information

Family Information – List yourself, your spouse (if married) and your dependent children. Provide the person’s full name, relationship to you, and age.

- Click the Add New Family Member button to add each person to the chart, start with yourself.

- Do not include Foster Children.

If you make an error, use the Delete button within the chart to remove a family member.

Step Three: Student/Spouse Income

Select the “Student Income” tab or click the Next-Student Income button under the Household Information tab to go to the next section of the form.

NOTE: Answer income questions about yourself (the student). If you are married or remarried include information about your spouse.

Tax Filing Status – Indicate whether you filed or will file a federal income tax return; otherwise, indicate that you are not required to file a federal income tax return with the IRS.

a. If you Filed Taxes:

- Select the Tax Return Filer option

- Select “I, the student (and spouse), consented and approved to retrieve and disclose federal tax information (FTI) in FAFSA on the Web to transfer 2022 IRS tax return data into my FAFSA.

- You do NOT need to submit any tax documentation

- Note: The consent to transfer income information is not available to California Dream applicants.

b. If you Filed Taxes and Will Submit IRS Tax Return Transcript or other acceptable income tax documents:

- Select the Tax Return Filer button

- Select “I, the student (and spouse), am unable to retrieve and submit my federal tax information (FTI) in FAFSA on the Web, and instead will provide the Financial Aid & Scholarship Department with a 2022 IRS Tax Return Transcript or a signed copy of the income tax return and applicable tax schedules.

- Dream students select “I, the student (and spouse), will provide the Financial Aid & Scholarship Department my 2022 IRS Tax Return Transcript(s) or other acceptable income documentation.

c. If you Did Not Work Or Earn Income:

- Select the Tax Return Non-Filer button.

- Select “I, the student (and spouse), was not employed and had no income earned from work in 2022.

d. Student Earned Income Below the IRS Requirement to File

- Select the Tax Return Non-Filer button

- Select “I, the student (and spouse), was employed in 2022 and earned money, but was NOT REQUIRED to file a 2022 income tax return with the IRS.”

- Select “I, the student (and spouse), will provide the Financial Aid and Scholarship Department with a copy of all 2022 IRS W-2 forms issued by employers as well as CSUN’s Verification of Non-Filing Form.”

- Complete the Student/Spouse Earnings section.

SPECIAL INSTRUCTIONS FOR STUDENTS MARRIED/REMARRIED AS OF FAFSA/DREAM APPLICATION FILING DATE BUT NOT MARRIED BY END OF PREVIOUS CALENDAR YEAR:

If you are married/remarried on the day the Free Application for Federal Student Aid (FAFSA) or California DREAM application is initially submitted, BUT you and your spouse did not file taxes together for the previous year because you were not married at the time, you must still report combined income for you and your spouse on the FAFSA or California DREAM application.

On the Independent Verification Worksheet E-form, please answer questions regarding Tax Filing Status and Tax Non-filer as they apply to the student. Students should submit income documentation for both student and spouse to our office (i.e. separate income tax transcripts or W-2 wage statements for Non-filers).

Example – You and your spouse each filed taxes separately as “Single” for the previous year. You were married the next calendar year on January 7 and you submitted your FAFSA on February 21. On the E-form you will select you are a “Tax Return Filer” and indicate you will provide our office with your IRS Tax Return Transcripts and mail or bring in person both Tax Return Transcripts. You will answer all other sections of the E-form, such as assets, child support paid, etc. as they apply to both you and your spouse.

Step Four: Certify, Review, Print and Submit Form Electronically

Certification and Signature – You must check the box to sign your electronic form.

Review and Print E-form – It is important that you provide accurate responses to all questions, especially required fields which are denoted with an asterisk.

a. Use the Print button to review and print the Electronic Independent Verification Worksheet.

- Click the Print button located at the bottom of the form.

- Please keep the printout for your records. You do not have to submit a copy to the Financial Aid & Scholarship Department.

![]()

- The system will review the electronic form for completeness and/or errors.

- You will not be able to print if your electronic form is missing information or if there are errors to resolve.

a. After you successfully print the E-form, the Submit button will become available.

b. Click the Submit button once located at the bottom of the form.

Submit the E-form ONCE – Click the Submit button one time to transmit your data to the Financial Aid & Scholarship Department.

![]()

c. If you make an error, do not resubmit this form.

- Please contact the Financial Aid & Scholarship Department at (818) 677-4085 or come into the Bayramian Hall lobby windows for further instructions

d. You will receive the following message. Click OK to proceed and submit your E-form to the Financial Aid & Scholarship Department.

e. You will receive a confirmation page.

Step Five: Upload or Mail Documents

If required, submit IRS Tax Return Transcripts or any documents to the Financial Aid & Scholarship Department using any ONE of the following options: CSUN Portal or mail.

CSUN Portal – submit the documents by logging onto the CSUN Portal. Once you are logged in, the Financial Aid Document Upload page is located under – My Finances – Financial Aid & Scholarships – Financial Aid Essentials - Financial Aid Forms. You can view the tutorial on How To Submit Documents to learn how to navigate to the Financial Aid Document Upload page.

Mailing address:

California State University, Northridge

Financial Aid & Scholarship Department 18111 Nordhoff Street

Northridge, CA 91330-8307

For detailed information about documents you may need to return to us, please review the Verification Guide.

How to Obtain Tax Return Transcripts

View samples of a Tax Return Transcript by clicking here.

To print tax return transcripts online:

- Go to http://www.irs.gov/Individuals/Get-Transcript

- To register and use this service, you need:

- your SSN, date of birth, filing status and mailing address from latest tax return,

- access to your email account,

- your personal account number from a credit card, mortgage, home equity loan, home equity line of credit or car loan, and

- a mobile phone with your name on the account.

Click on

- If you are a first-time user you will have to register and create an account

- You will need to have the following information available when creating your account: Full Name, Email, Birthdate, Social Security Number (SSN) or Individual Tax Identification Number (ITIN), Tax filing status, Current address, Credit Card, and Cell Phone Number.

- Once you have created an account you will be able to log in

- Select the reason you are requesting a transcript as “Higher Education/Student Aid” and click “Go”

- Select “Tax Return Transcript” and in the Tax Year field, select the year “2019”

- Print the document and submit a copy to the CSUN Financial Aid Office

If unable to request tax return transcripts online, request by phone:

- Call 1-800-908-9946 to use the automated system, or call 1-800-829-1040 to speak to an IRS Representative.

- You will need the tax filer’s Social Security Number and the address on file with the IRS.

- The tax filers can expect to receive a paper IRS Tax Return Transcript at the address on file with the IRS within 5 to 10 days.

If unable to print tax return transcripts or request by phone:

Click on

- Click “OK” on pop-up message box

- Provide the Social Security Number and date of birth of the primary tax filer

- Provide the address and zip code currently on file with the IRS

- Click “Continue”

- Select “Tax Return Transcript” and in the Tax Year field, select “2019”.

- If successfully validated, tax filers can expect to receive a paper IRS Tax Return Transcript at the address on file with the IRS within 5 to 10 days.

To request tax transcripts for victims of Identity Theft:

- Call the IRS at 1(800)908-4490

- Follow the prompts and you will be transferred to an IRS agent who will verify your identity.

- The IRS will mail a printout of you IRS income tax return information that you provided to them.

You must also submit a statement signed and dated by the tax filer indicating that they were victims of IRS tax-related identity theft and that the IRS has been made aware of the tax-related identity theft. Attach a cover sheet with the student’s name and CSUN ID number to a copy of the tax return transcript and statement then submit it to the Financial Aid and Scholarship Department either in person in Bayramian Hall or by mail.

DO NOT write or make any markings on the tax return transcript. DO NOT submit the original tax return transcript(s) as they will not be returned. The Financial Aid office will not make copies.

If unable to request tax return transcripts:

- Submit a signed copy of your or your or your parents’ 2019 federal 1040 tax return. (this substitutes for a tax transcript)

View samples of a 1040 Tax Return. You can also see what Schedule 1, Schedule 2, and Schedule 3 look like. Schedules will be included only if you or your parents were required to complete them. These are only examples and should not be used to submit.

How to Obtain Verification of Non-Filing Letter

View samples of a Verification of Non-Filing Letter by clicking here.

IF YOU HAVE PREVIOUSLY FILED A TAX RETURN, USE ONE OF THE FOLLOWING OPTIONS TO OBTAIN VERIFICATION OF NON-FILING LETTER:

Option 1-Print it online:

- Go to http://www.irs.gov/Individuals/Get-Transcript

- Click on

- If you are a first time user you will have to create an account

- Once you have created an account you will be able to log in

- Select the reason you are requesting a transcript as “Higher Education/Student Aid” and click “Go”

- Under the box titled “Return Transcript” select the year “2019”

- A pop up window will display your Verification of Non-Filing letter

- Print the document and submit a copy to the CSUN Financial Aid Office

- Please be aware that you will need to have the following information available when creating your account: Full Name, Email, Birthdate, Social Security Number (SSN) or Individual Tax Identification Number (ITIN), Tax filing status, Current address, Credit Card, and Cell Phone Number.

Option 2- Order it online to receive by mail:

- Go to http://www.irs.gov/Individuals/Get-Transcript

- Click on

- Click “Ok”

- Enter the tax filer’s Social Security Number (SSN) or Individual Tax Identification Number (ITIN), Date of Birth, Street Address, and ZIP code.

- Select “Continue”

- Under “Type of Transcript” select “Return Transcript” and “2019” for “Tax Year”

- Click “Continue”

- You will see a confirmation that your request was submitted. You can expect the letter to be delivered to your address in 5-10 business days

Option 3 – Order it by phone to receive it by mail:

- Call 1-800-908-9946 to use the automated system, or call 1-800-829-1040 to speak to an IRS Representative.

- You will need the tax filer’s Social Security Number, date of birth, and the address on file with the IRS.

IF YOU HAVE NEVER FILED A TAX RETURN, USE THE FOLLOWING OPTION:

- Download IRS Form 4506-T at https://www.irs.gov/pub/irs-pdf/f4506t.pdf

- Complete lines 1-4 as they apply to you

- Select the checkbox on the right hand side of Line 7 for Verification of Nonfiling.

- For Line 9: Year or period requested field, enter "12/31/2018".

- The tax filer must sign and date the form and enter their telephone number. Only one signature is required when requesting a joint IRS Verification of Nonfiling Letter.

- Mail or fax the completed IRS Form 4506-T to the address (or FAX number) provided on page 2 of Form 4506-T. Do NOT send the form to CSUN.

- If the IRS is able to successfully process your request you can expect to receive a paper Verification of Nonfiling Letter at the address provided on the request form within 5 to 10 days.

- Once you have the paper Verification of Nonfiling Letter submit a copy of it to the CSUN Financial Aid Office via postal mail or in person; make sure to include the student’s name and ID number on the letter.

IF YOU HAVE NOT BEEN ABLE TO OBTAIN A VERIFICATION OF NON-FILING STATUS FROM THE IRS, YOU CAN SUBMIT THE FOLLOWING INSTEAD:

- CSUN Financial Aid Department’s Verification of Non-Filing form - The form is available to download at: https://www.csun.edu/financialaid/forms-documents

How to Submit Proof of Eligible Noncitizen Status

Based on the information provided on your application, you must provide proof of your eligible noncitizen status.

You must complete the Confirmation of Eligible Noncitizen Status form. To access the form, go to: http://www.csun.edu/financialaid/forms-documents. You can submit your form along with the required documentation via upload, mail, or fax. You can visit our main page for details on each available option.

Acceptable documentation of eligible noncitizen status may include Form I-551 or Form I-94. You must submit your unexpired, original non-citizenship document(s) in person. If there is an expiration date on your document, the date must be after the start of the fall semester in the academic year for which the document is requested.

As required by federal law, this office will send the Department of Homeland Security (DHS) a copy of the documentation to verify eligible noncitizen status.

If there is not a photo on your document, or if the picture on your document was taken when you were 14 years old or younger, you must also present valid government photo identification.

If you are now a U.S. citizen, please read the how-to guide for submitting proof of U.S. citizenship status by selecting the "Citizenship" tab.

If you have questions about immigration documentation, contact the Financial Aid & Scholarship Department immediately. Delays in submitting this information will slow your financial aid application process.

How to Submit Proof of U.S. Citizenship

The following are acceptable forms of original documents to verify U.S. citizenship status:

- a birth certificate

- a valid U.S. passport book: current or expired

- a valid U.S. passport card: current or expired

- a Certificate of Naturalization from the United States Citizenship and Immigration Services

- a Certificate of Citizenship from the United States Citizenship and Immigration Services

- a Report of a Birth Abroad of a Citizen of the U.S. bearing an embossed seal with the words "United States of America" and "State Department" (Form FS-240, FS-545 or DS-1350 all acceptable)

If you do not have access to any of these documents and you are a U.S. citizen, contact the appropriate government agency and make arrangements to have a copy of the document sent to you.

The following contact numbers may help:

- Country Registrar's Office: 1 (800) 201-8999

- United States Citizenship and Immigration Services: 1 (800) 375-5283

- U.S. State Department: (310) 575-5700

You must submit the “Confirmation of Update to Citizenship Status” form along with a copy of your original citizenship document to the Financial Aid Office via upload, mail, or fax. You can visit our main page for details on each available option. To access the form, go to: https://www.csun.edu/financialaid/forms-documents