The CSUN VITA Clinic

The CSUN VITA Clinic

The CSUN VITA Clinic

The CSUN VITA Clinic

The CSUN VITA Clinic

The CSUN VITA Clinic

The CSUN VITA Clinic

The CSUN VITA Clinic is now closed for tax preparation. We will resume operation in Mid-May 2024!

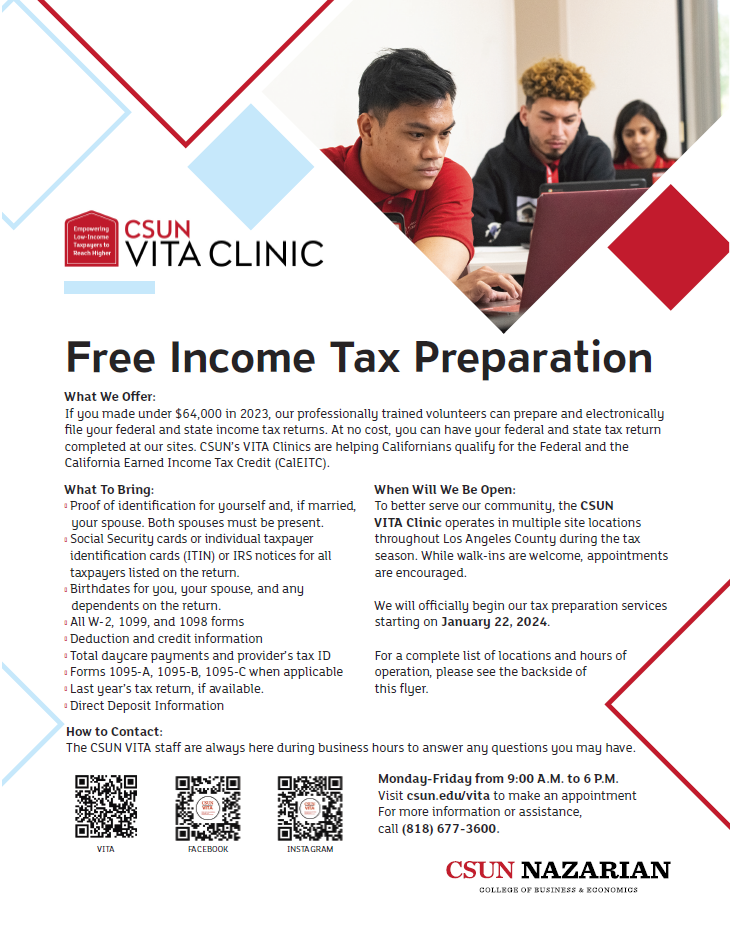

Serving the public since 1970, CSUN VITA Clinic is a cost-free income tax assistance service to low-income residents in the San Fernando Valley and beyond. Our goal is to provide outstanding free tax preparation service to low-income taxpayers in our community and to provide our students with a quality experiential learning experience in the field of taxation.

CSUN VITA Clinic provides cost-free income tax assistance to low-income residents.

In 2023, the CSUN Volunteer Income Tax Assistance (VITA) Clinic clinched the top ranking among more than 6,700 VITA sites nationally in terms of returns transmitted. Powered with the support of over 298 student volunteers, the CSUN VITA Clinic provided free tax preparation to over 8,500 low-income taxpayers in Los Angeles County. In all, CSUN VITA Clinic helped taxpayers claim nearly $8 million in tax refunds and $2.8 million in federal and state Earned Income Tax Credits, saving them over $1.9 million in tax preparation fees. The clinic operated a total of 14 tax preparation sites throughout Los Angeles County operating six days per week to help low-income taxpayers submit their tax returns and obtain their tax credits and tax refunds. CSUN’s VITA Clinics are helping Californians qualify for the California Earned Income Tax Credit (CalEITC).

All services are by appointment only.

The best way to contact us is by emailing at or calling us at (818) 677-3600.

Disclaimer: We recommend checking if you qualify before making an appointment. The VITA program has limitations that may prevent us from serving you.

If you would like to try finding other free tax preparation sites,

visit Free Tax Prep Help on the IRS website.

Enrollment in the CSUN VITA Clinic for the Spring of 2024 is now closed. Please check back with us in November 2024 for more volunteer opportunities! Check out the students' tab on the left.

Under the supervision of experienced tax practitioners, trained and certified CSUN students provide free tax preparation services (federal and state) to eligible low-income taxpayers. Services are offered at the CSUN campus and several remote sites in the community beginning in late January through mid-April each year.

The CSUN VITA Clinic is sponsored by the Bookstein Institute for Higher Education in Taxation in the Department of Accounting & Information Systems at the David Nazarian College of Business & Economics. While supported by the IRS, the CSUN VITA Clinic is not part of or affiliated with the IRS.

The CSUN VITA Clinic does not discriminate against any person based on race, color, national origin, disability, or age in admission, treatment, or participation in its programs, services, and activities, or employment. For further information about this policy, or if you need special accommodation for the services we provide, please contact us at least one week before your scheduled appointment at (818) 677-3600.