Students from all disciplines at the university may join VITA. Recruitment for the VITA season begins in the fall. Students may enroll in a VITA course and receive academic credit, or they can simply volunteer with no academic credit. All VITA students must complete tax preparation training during the month of January and pass the IRS VITA test at the conclusion of the training. Once certified as VITA volunteers, students are assigned to serve in one of our many tax preparation sites in Los Angeles starting in late January through April 15. Students may serve as a Preparer, Supervisor, or a Lead Supervisor.

The Internal Revenue Service Office of Chief Counsel has stated that VITA volunteers are not “income tax preparers” under I.R.C. § 7701(a)(31) because we do not prepare returns for compensation. Thus, CSUN VITA Clinic volunteers who assist taxpayers are not legally responsible for the accuracy of the returns, are not required to sign the returns, and need not retain the records required of commercial income tax preparers.

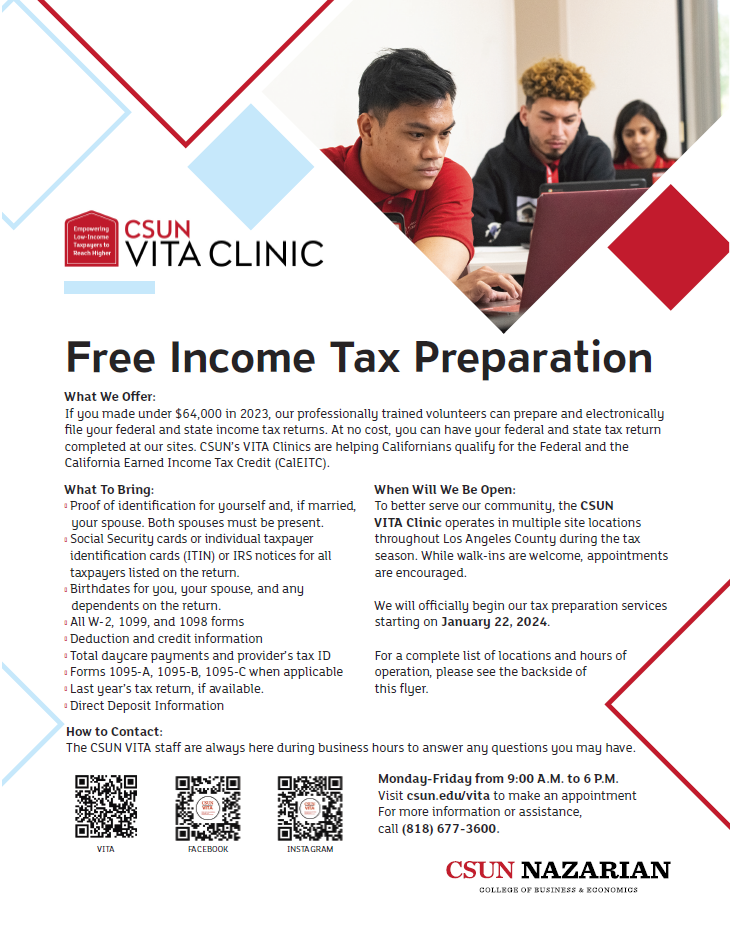

You may call the CSUN VITA Clinic Office at (818) 677-3600, send us an email at vita@csun.edu, or visit us in person in Bookstein Hall Room 1109.