“But It’s Only Plastic!”: The Credit Card Trap

By

Johnie H. Scott, M.A.,

M.F.A.

Associate Professor

Pan African Studies

Department

Key Concepts:

1. Pseudonym

2. Peer Pressure

3. Instant credit approval

4. Pre-approved

5. unravel

6. Credit Report

7. slew

8. delinquent payment(s)

9. bankruptcy

10. conundrum

11. Living within means

12. Usury Laws

Raheem

Tolliver (pseudonym) is about to start his college career as a firstyear freshman at CSU Northridge (CSUN). Raheem just recently turned 18 years old. As a PWT (i.e.,

Permit with Transportation) student, he attended Alfred Noble Middle and

Raheem’s mother Shirlene Tolliver raised him and his younger brother Rashad by herself. A single parent mother in her late 30s, Shirlene was a widow. Her late husband Jerry – father of Raheem and Rashad – lost his life in a automobile accident. Raheem was six and Rashad was four years old at the time. Shirlene entered a Allied Health Careers training program, finishing it as a Phlebotomist. She supported herself and her two sons by working at the Hubert H. Humphrey Health Care Clinic on 54th and Main Streets. Mrs. Tolliver supplemented her income with food stamps and other forms of public assistance.

Her own family of brothers and

sisters reside in

Raheem

is the first in the family to attend college. He is entering Northridge after

an Educational Opportunity Program (EOP) recruiter visited

Raheem has no car. However, since he lives on campus this wasn’t a problem. Raheem’s biggest concern is being able to afford the high cost of campus housing, tuition and fees, books and lab expenses, in addition to basic living needs. The Pell grant only helps a small bit. Raheem applied virtually his entire student loan to paying for housing. He is in the sort of situation not unusual to college students: having to stay within a strict budget and live within his means.

Then, things began to unravel.

With budget cutbacks hitting the

County Health Services system especially hard, Shirlene

was laid off from

What complicated matters, though, was that younger brother Rashad was not having the same success Raheem did in avoiding the neighborhood’s gang peer pressures. Raheem was deeply troubled by his brother’s long absences from their two-bedroom apartment. These frustrations were heightened by the fact that whenever Rashad returned from those absences, it was with a vengeful attitude and blatant lack of respect for their mother. Raheem desperately wanted to spend time with Rashad, to show this younger sibling there was a way to beat the odds and defy the system that was claiming the lives of so many of the young men and women in the neighborhood through gangs, incarceration, drugs or a combination of them all.

The two didn’t have to travel far at all to see the Crack Houses with traffic flowing through 24 hours a day. The young women, many of them in their teens, now prostituting themselves for a “hit off the pipe.” Raheem and his friends called these young women “Strawberries.” Neither did Raheem and Rashad have to go very far to see 12 and 13-year olds selling drugs on the streets, many of them with large rolls of bills in their pockets, all the time bragging about making more money as fifth and sixth graders in school than their unemployed, absentee fathers and drug-addicted mothers. The money these kids made from selling drugs helped buy groceries, clothing, and furniture in those homes. Furthermore, the parents knew what their kids were doing.

Shirlene Tolliver was aware of what was going on, perhaps even better than her two sons. And it came from what she knew, and had seen, in the course of her 38 years on this earth that this spirited Black mother refused to let the streets devour her own sons even while listening compassionately to neighbors speak of losing another child to gang violence, or seeing another one sent off to prison. While Raheem and Shirlene waited at the family home for Rashad to come and join them for the small family bar-b-que that Labor Day Weekend, she chose that time to let her oldest son know as much.

“Raheem,” she said while slowly and carefully choosing her words, “I know it may not mean much to you right now, but you are all that I have. If you don’t make it in college, if you don’t go on ahead and graduate, then everything that we’ve been through has been just one great big waste of time. Look around you! I ain’t telling you nothing that you don’t already know.”

She paused to catch her breath, walking over to pull the curtains back from the window looking out onto the crowded, busy streets below. Speaking with even more passion now, Shirlene said, “It’s dangerous out there. Young kids are getting shot and killed all the time. All these young girls, not much bigger than kids, doing anything to get themselves some of that crack. You see their mothers spend those County checks on drugs while their kids go without food and shoes or the rent being paid, then having to use car batteries to keep the lights on. It’s a damn shame the way people are being made to live, but that’s just the way it is!”

She moved over to embrace Raheem in a big hug before saying, “I want you and Rashad to do better than all this out here. You can. All you got to do is go to that college and get your degree.” She stepped back, looking her son full in the face with all the love only a mother can show and said, “Don’t worry none ‘bout me and Rashad. We’ll manage.”

Outside the tiny apartment, a Ghetto bird, a police helicopter, could be heard whirling overhead while the sound of sirens punctuated the air. Rap music blared from a ghettoblaster carried by a group of young men and girls dancing on the street corner across from the apartment.

Mrs. Tolliver walked back to the window, looking down at the blue-clad kids swaggering their way down 87th and Main throwing gang signs at passing cars. She shook her head sadly, and spoke to Raheem without turning her head from the sight of those young kids.

“Just you remember one thing. The

same way I got that job at Hubert Humphrey, I can get another. And I damn sho ain’t gonna let Rashad and me suffer or do without just

because of some layoff. I’m planning on enrolling at

Shirlene’s voice, which normally had a deep contralto tone to it, choked up as she said, “The only thing I want you to do is make certain I don’t have anymore burdens laid on my shoulders by you not going to school next week. That would break my heart!”

A knock came on the door. Both looked up and Raheem moved over the answer it. He cracked the door open, peered through it and quietly said, “It’s Rashad, Mamma.”

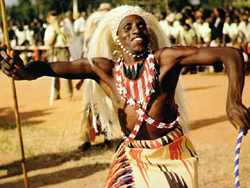

Tutsi Dancer

Tutsi Dancer

Registration

“Wonder if they can tell this is my first day of school?”

Raheem couldn’t help asking himself this question while standing in the long line outside the Matador Bookstore waiting to be allowed in to purchase his books. He definitely felt conspicuous while the other students in front of and behind him talked about what they had been doing for the summer. Raheem was enrolled in 15 units that included a Developmental Writing course in the Pan African Studies Department (He was still questioning whether the PAS class was “equal” to the same course offered by the English Department), a Biology 100 class, the Biology 100 lab, a five-unit Developmental Math class and Sociology 150. The schedule was developed after Raheem told his peer counselor of his intention to be a Health Science major since his career goal was to be a pediatrician.

Raheem had been hired as a student assistant through the Work Study Program. He was working the maximum allowable hours, 20 per week. With thoughts of his mother Shirlene and brother Rashad very much on his mind, this young man was looking for a second job on the side. He had decided not to let anyone know until the job, whatever it might be, was confirmed. The long line began moving and Raheem soon found himself close to handing his entrance ticket to the monitor. This freshman’s eyes opened wide as he noticed the long table just in front of the Bookstore entrance with the signs posted atop.

American

Express here.

VISA

Card here.

Mastercard here.

“Instant

approval in 15 minutes for college students with your ID!”

“No prior credit

history necessary. Start your credit here!”

“Are they for real?” Raheem thought. Then, he heard himself speaking aloud, asking the Asian-American student next in line to him if those signs were really true.

“You bet your ass they are!,” the student replied as he went inside the Bookstore before adding, “I got my American Express and Mastercard right here last year!”

Shirlene Tolliver had owned only one credit card her entire life, Raheem thought, and that was to the J.C. Penney store where she took him and charged her limit o get clothes he could wear to college. The 18-year-old college freshman inched over to the long table for a better look. In less time than it takes to read this, Raheem had applied for all three credit cards. He was approved for each one and told by the smiling representatives (themselves students working on commission for each credit history and application taken), “You can expect to receive your card within the next 10-14 working days.”

Raheem

went inside the Bookstore where he quickly spent $384 on textbooks and

supplies. He began the walk back to his apartment at the

Thinking of the books he had just bought, Raheem thought about the $384 he had just spent and how he still had to buy notepaper, files, folders and highlighters.

“That’s alright,” he said to no

one in particular while walking down

As he entered the University Park Apartments, the line of students queuing up in front of the “Instant Credit Approval” table began to lengthen.

Discussion

Every year, thousands of young people like Raheem start off their college lives by getting “instant credit approval” for a slew of credit cards. In a society increasingly geared towards plastic money, it is easy to understand the temptation this holds for students who really could use a little financial help on the side that is not covered by scholarships, grants, student loans and part-time jobs. The appeal is a simple one: buy now and pay later. What students fail to realize is that the “pay later” clause is a binding one and carries heavy penalties for those who miss making those payments.

This is particularly true for the major credit cards: American Express (which insists that the balance be paid in full when due!), Mastercard/Mastercharge, Visa and Discovery. It is made even more complicated by the many cards available on the Internet offering secured and unsecured accounts. For the college student already on a tight budget, the added payments from credit cards become not the straws, but the boulders that smashed any camel’s back!

The reality, plain and simple, is how one is going to make those payments, avoid those nasty letters and phone calls from collection agencies, and keep those “delinquent payment” notices off one’s credit profile. Imagine a bad credit rating before you’ve turned 19 years old, a credit rating that will stay with you for at least seven (7) years while affecting your ability to get the things later on in life you really want and truly need.

It isn’t just the major credit cards that trap students. There are the Department store cards that young women love to get – sometimes as many as 10-15 . This is particularly true for those coming from low-income communities and backgrounds, as they can now go out and “max the cards out” while buying gold necklaces, earrings, Giorgio and all the latest fashion apparel. One sees the stack of unopened bills from those same stores insisting on “minimum” monthly payments that range from $50-$100.

These are the young people most at risk of accruing $3000-$4000 in credit card bills with no viable means of paying the balances. These become the students suddenly in need of a full-time job to pay off those bills hoping to put an end to the nagging calls not just at their dorm rooms but homes, so that now the parents have become involved. The part-time student job – never intended to serve as a front for paying American Express – is not enough to see them through. For students entering college with weak study skills in reading, writing, math, critical thinking and time management, students coming out of deficient public schools and who definitely need the help and assistance provided through Writing Centers and tutors, all of a sudden their college dreams and hopes have been placed on hold: sometimes indefinitely.

These are the students who don’t make it past that freshman or sophomore year. It doesn’t matter whether they had good grades in high school. It doesn’t matter that they are the first in the family to attend college because they are in imminent peril of being the first to drop out. It doesn’t matter that they want to own their own business one day, or be a civil engineer, a pediatrician, go into broadcasting, be an attorney, or a teacher working with eighth and ninth graders at a school like the one(s) they attended. None of those ambitions matter because they will never materialize. These are the profiles of young people whose lives have been placed on hold, before ever making it past their 19th birthday, and all because of “Instant Credit.”

What can this student do?

The very first step any young person can take to insure survival past the first year of college is to live within his or her means. In a society where it now takes two parents working to match the salary of that father-headed household of the 1960s and 1970s, a world where working parents find themselves in a pinch every month “making ends meet” while raising families and developing careers, just think of the difficult spot the collegian places himself or herself into by collecting plastic – knowing the temptation to use those cards is constantly there, as addictive and seductive as any narcotic?

Unfortunately, this is not the type of situation that can be neatly wrapped up at the end like a segment from your favorite show. The sad truth is that, before the year is half over, someone you know, someone close to close, perhaps even you, will become yet another casualty of the Credit Card Trap.

Discussion Questions

- If you were Raheem’s roommate and knew he had just acquired those three credit cards, what advice would you try to give him? Why?

- Do you know of someone who is a casualty of the Credit Card Trap? Who? Describe that person’s situation? Have they learned from it? Did you?

- What are your personal beliefs about credit cards and college students?

- What do you say to the student who is inevitably going to say, “Aw, I can handle it!” (The student who is in pure denial about the seductive lure of instant credit)

- According to usury laws, private citizens were forbidden from charging more than ten (10) percent on a loan made to another party. These usury laws were negated by a rapidly rising prime rate in the mid-1970s. Banks and businesses now charge substantially more than the 10 percent rate. What is the average interest on (1) Mastercard/Mastercharge, (b) VISA, and (c) American Express?

- If Raheem owes VISA $1000 in charges, how much will this young man owe if he does not make any payments for one year?