Wednesday, May 1, 2024 11:00 am - Noon

Tuesday, May 7, 2024 10:00 - 11:00 a.m.

Sum/Fall '24 Priority Application Processing thru Apr 19

Online | Anytime

Your Go To Resource

Virtual Appointments Available

Professional & Personal Development

Time and Labor Timesheet/Fact Sheet for Non-Student Employees:

All hours worked (e.g. regular, overtime, and shift differential) for hourly employees, and overtime and shift for salaried non-exempt employees are recorded on the Timesheet in the Time & Labor module. Listed below is general reference information regarding time reporting. For step-by-step instructions on how to access and report time in the system, refer to http://www.csun.edu/payroll/solar-self-reporter-student-employee-enter-time-sheet-data

All employees who are eligible to accrue and use leave time (e.g. vacation, sick, personal holiday, etc.) should report absences in the Absence Management module. Information about Absence Management is available at SOLAR HR at:

1. HOURLY EMPLOYEE CLASSIFICATIONS:

Hourly employees may be assigned to the following job classifications:

Casual Work (1800)

Hrly Intrprt/Rltmecap/Catscrbr (7193)

Other Job Codes As Assigned

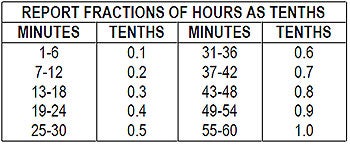

2. TIME REPORTING CONVERSION CHART:

The conversion chart for reporting partial hours worked on the Timesheet is shown below. All partial hours worked must be reported to the tenths of an hour. For example, report 2.30 hours for work from 8:00 a.m. to 10:15 a.m. and not 2.25 hours. Time that is reported to the hundredths of an hour will not generate pay (e.g. 2.25).

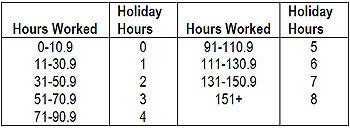

3. HOLIDAY PAY:

Holiday pay is based on the number of hours worked in the month the holiday is observed. All hours worked during the pay period are taken into consideration when computing holiday hours (exclusive of the holiday hours not actually worked). Holiday hours are to be recorded in the Absence Management module (not the Time & Labor module).

4. HOLIDAY PAY ELIGIBLE CLASSIFICATIONS:

Hourly employees who accrue leave time (e.g. vacation, sick, etc.)

Casual Workers (Job Code 1800)

NOTE: Rehired Annuitants are not eligible for holiday pay regardless of job classification.

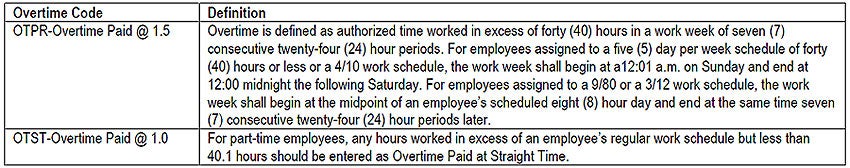

5. OVERTIME:

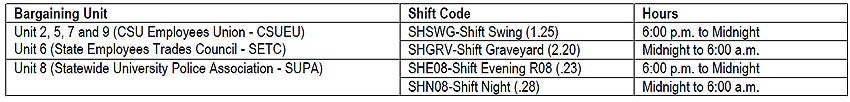

6. SHIFT:

Certain bargaining units and job classifications are eligible for shift differential. Please consult with the department to determine if a specific job classification and schedule falls within the guideline for shift eligibility.

Note: An eligible employee who works 4 or more hours during shift time shall be paid the shift differential for the employee’s entire shift.

For hourly employees, shift hours must reported on the Timesheet using the regular time code plus the shift time code for every hour worked.

Example 1: Employee worked 4 hours (5:00 p.m. to 9:00 p.m.), report 4 regular hours and 3 shift hours; this entry will result in 4 hours of regular pay + 3 hours of shift differential for the shift time worked from 6:00 p.m. to 9:00 p.m.

Example 2: Employee worked 6 hours (4:00 p.m. to 10:00 p.m.), report 6 regular hours and 6 shift hours. Since the employee worked at least 4 hours during shift time, the shift differential will be paid for the employee’s entire 6-hour shift. For salaried employees, only report the applicable shift hours, do not report regular time (e.g. only report 3 shift hours using Example 1 mentioned above or only report 6 shift hours using Example 2),