To be eligible, you must be employed half time or more in an appointment that exceeds six months and one day. Temporary faculty (AY Classification) must have 6.0 units or more for at least one semester, including the current semester.

If you do not meet the standard benefits eligibility but are hired at least at a .75 timebase, you are eligible to enroll in health (medical only), regardless of appointment duration.

No, you may enroll in benefits prior to attending the New Employee Orientation. Please complete your enrollment forms within 60 days of your hire date.

I. Does CSUN have a Flexible Spending Account plan?

Yes! These programs allow you to pay for dependent care and/or health care out-of-pocket expenses with pre-tax dollars. Health Care Reimbursement Accounts (HCRAs) are designed to assist you in paying for health care expenses with pre-tax dollars, for example, paying deductibles or co-payments. Dependent Care Reimbursement Accounts (DCRAs) are designed to assist you in paying for child care or adult day care for dependent adults, also with pre-tax dollars.

You may enroll during the first 60 days of your employment.

You must re-enroll in these programs each year.

Administrative fee remains $1.00 per month for each plan.

Access the Health Care Reimbursement Account (HCRA) Brochure.

Access the Dependent Care Reimbursement Account (DCRA) Brochure.

Domestic Partner's Benefit Tax Implication:

The Internal Revenue Service ruled that the actual cost of domestic partner benefits is taxable income to the employee. To arrive at the actual cost of this benefit, the CSU examined the premium structure for health, vision, and dental benefits. For health and dental, CSU has the following structure:

- Employee only

- Employee plus one dependent

- Employee plus two or more dependents

For these two benefits, the taxable income of the domestic partner benefit will be the cost difference between the employee only and the employee plus one dependent premium rate. This approach recognizes the value of adding one dependent, using a single employee as the base line. The State Controller’s Office will use a flat tax rate of 22% Federal, 6.2% Social Security, and 1.45% Medicare to withhold taxes on the value of the benefits.

NOTE: Employees who claim their Domestic Partners as tax dependents are not subject to the imputed tax liability.

For vision, the cost is a flat rate regardless of the number of dependents. Adding domestic partners to the program will have a negligible impact on the premium. As a result, there is no taxable income to you for adding a domestic partner to your vision insurance plan.

To enroll or make changes, you will need to have completed and have on file the eBenefits Self-Service Electronic Signature Authorization Form.

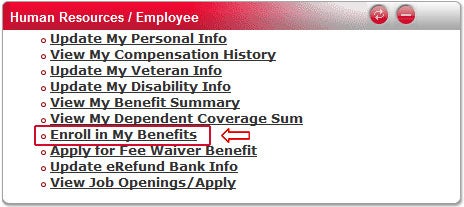

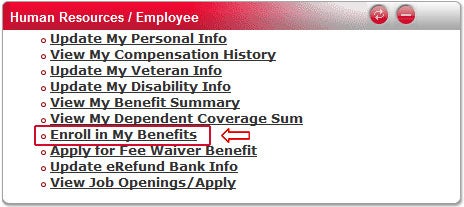

Once you have decided upon your choice of a medical and dental plan, to receive FlexCash, or to participate in a Health Care/Dependent Care Reimbursement Account and are ready to enroll, navigate to the CSUN homepage, login to the myNorthridge portal and select the "Enroll in My Benefits" link in the Human Resources/Employee pagelet.

If you are making a change under a “Qualifying Event” such as a family status change please contact your Benefits representative at extension 2101.

If you'll be enrolling any eligible dependents, you'll need to have the following information ready to complete the enrollment process:

- Their full, legal name

- Their date of birth

- Their Social Security Number

- Their relationship to you

Below is a list of eligible dependents that can be enrolled in the CSUN medical and dental plans followed by the required documentation you will need to submit to Human resources before your dependent's coverage can take effect:

If you are adding dependent children, submit a copy of a Birth Certificate (under 26 years of age). When adding a parent-child relationship, additional documentation may be required.

- CHILDREN OVER AGE 26 WHO ARE DISABLED and became disabled before age 26 and who depend on you for economic support

Please contact Human Resources/Benefits for required documentation.

If you are adding a spouse, submit a copy of your Marriage Certificate.

If you are adding a registered domestic partner, submit a copy of the approved Declaration of Domestic Partnership that you received from the California Secretary of State.

Required documents may be dropped off at Human Resources, University Hall 165 or scanned and emailed to

if your last name begins with the letter A-K or

if your last name begins with the letter L-Z.